Supercharging Growth through Customer Experience Transformation

For more than a decade, the ROI of Customer Experience has been discussed, with very few case studies or quantified examples of the growth and profit opportunity that Customer Journey transformation holds that C-Suites should be evaluating.

In that time, we at Gold Research were fortunate enough to work with dozens of companies to benchmark and realize more than $2 Billion of revenue from CX transformation, with one such project receiving the 2012 CXPA Innovation award for the “$100 Million Customer Journey”. We want to share the benchmarks and insights from this work in order to ensure that CX Transformation stays on the C-Suite Agenda – where it deserves to be.

Background

Our experience with CX Transformation has covered both B2B and B2C businesses across more than 20 industries. We worked with a wide variety of roles: CEO, President, CXO, CMO and COO’s to baseline the current customer experience, identify improvements that would improve their experience and then quantify the impact on revenues and costs from those improvements that build the business case for investing in transformational change. These industries include:

Awarded by Feedspot

![]()

Contact Us

1-800-549-7170

GoldResearch, Inc.

8000 I.H. 10 West | Suite 600San Antonio, Texas, 78230

B2C Industries:

- Consumer Financial Services

- Consumer packaging Goods

- Grocery products

- Housing products

- Insurance

- Lawn & Garden Products

- Quick Service Restaurant

- Residential Real Estate Services

- Staffing / Placement

- Travel Services

B2B Industries:

- Automobile remarketing

- Commercial Construction

- Commercial Office products

- Electrical equipment

- Enterprise Software

- Financial Services / SMB Fintech

- Financial software

- Industrial building systems

- IT Services

- Specialty Chemicals

Source: Gold Research, 2024

While we considered this “common sense”, we found it wasn’t “common practice”, given that:

- Forrester stated “54% of CX programs could not prove the ROI of their projects and efforts” and

- McKinsey reported that “only 15 percent of leaders said they were fully satisfied with how their company was measuring CX—and only 6 percent expressed confidence that their measurement system enables both strategic and tactical decision making”.

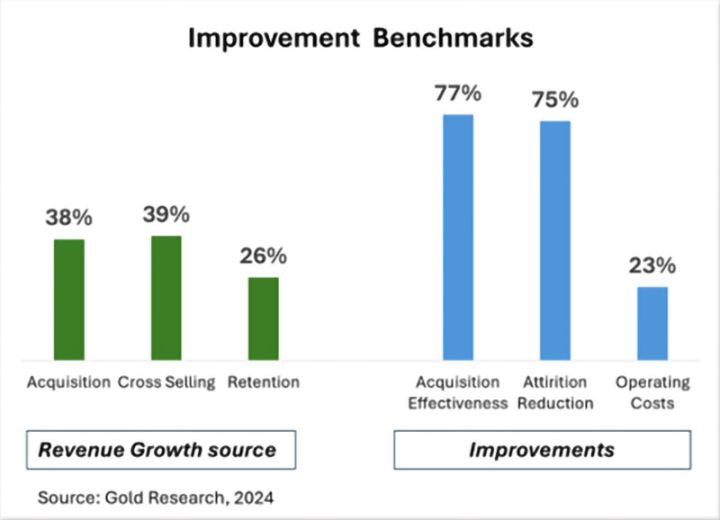

Growth Drivers and Benchmarks

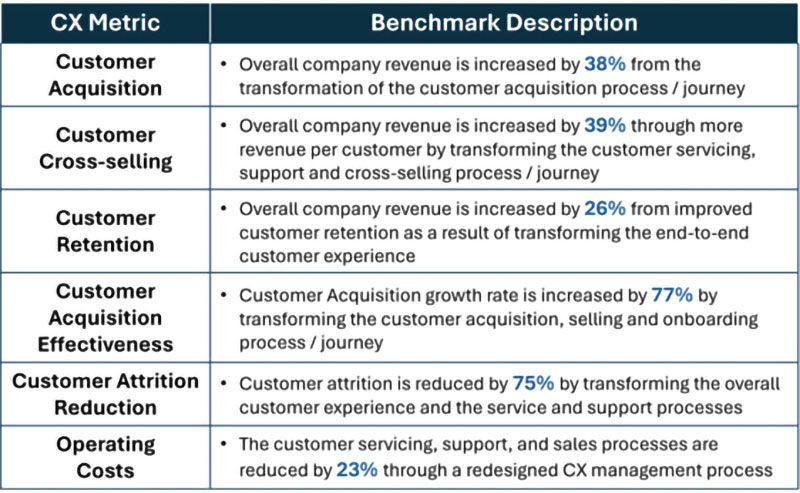

Most business leaders agree that an improved customer experience is likely to have these impacts:

- Customer Acquisition – positive word-of-mouth and well-designed acquisition experiences lead to faster, better new customer acquisition and onboarding, driving revenue growth

- Customer Cross-sell – improved product, support and servicing experiences lead to higher customer-share-of-wallet, broader product footprints and additional revenue growth

- Customer Retention – more satisfied customers are less likely to defect and for business customers, revenue retention is optimized with better served customers

- Lower operating costs – well-designed customer experiences don’t cost more, they cost less AND deliver profit improvements in addition to the previously described revenue growth

However for more than 10 years, it has been difficult to find real examples or benchmarks of the type of improvements that real companies can achieve through CX transformation. There are hundreds of “click-bait” messages touting “CX ROI” with no examples. And plenty of theory of how to calculate ROI without any guidance on how to get and justify the assumptions to overcome organizational scrutiny.

We wanted to put out our set of benchmarks and examples based on more than 20 case studies and encourage more discovery, inquiry and innovation into how CX opportunities can be identified, designed and realized for all companies.

An explanation of these benchmarks follows:

Source: Gold Research, 2024

We aren’t crazy – just experienced

There are likely to be skeptics about the benchmarks shown here, and we have heard most of them. The first is “you’re telling me I can double my revenues by improving my CX? I don’t believe you!” The answer is yes, the combination of improved customer acquisition (38%), cross-selling (39%) and retention (26%) is more than 100%, with could mean doubling your company revenues. And we stand by it. Here are a few examples:

CUSTOMER ACQUISITION & CROSS-SELLING – A chemical company found that their lack of a responsive process to send out samples for chemists to use for their product formulations was causing them to miss revenues equivalent to 80% of their current sales. Their inability to promote and cross-sell products to the very companies that were already using their products, (but only 1 of their products, while the companies had the need to use 4-5 of their products) would grow their revenues by another 20%. Customer research, internal operational data and sales and marketing leader analytic validation overcame CFO scrutiny of the business case. As a result, the CX effort received the top priority of the company, and the program delivered an ROI of over 500% in the first year.

CUSTOMER RETENTION – A Fintech company would acquire thousands of new small business customers every year, only to have more than 60% fail to renew just 12 months later. Their VOC analysis showed that 12-month retention of “Promoters” was 80% vs. a 20% retention rate for “Detractors”. An analysis of the service that Promoters vs. Detractors experienced identified 3 key drivers that illuminated what Promoters experienced, and Detractors did not. Addressing these 3 key drivers had an immediate, measurable and lucrative impact. The ROI of this improvement was over 300% in the first year.

Challenges and Barriers

“A CX leaders’ number one job is to prove ROI”, says Forrester’s Rick Parrish. But several barriers exist that prevent that vision from becoming a reality. Deloitte identified the following five key barriers:

- Connecting the dots between CX programs and business outcomes

- Lack of skills and experience by CX organization / team members

- Lack of cross-functional collaboration on CX priorities and implementation

- Identifying actionable customer experience metrics

- Designing specific, impactful and scalable experiences

Building the Business Case for Increased CX Investment and Impact

Building the business case needs foundational data, a well defined process and experienced leadership in order to overcome these challenges above and successfully navigate the skepticism and potholes that exist in most organizations for a cross-functional, transformational effort.

Before the business case can be built, foundational work must be in place. In our experience, the 2 following efforts are critical to have in place as the critical “discovery” that will provide the foundation for a solid business case. These efforts include:

- Qualitative Customer Journey / Experience Research – Understanding how key customer segments and personas perceive the customer experience throughout their journey / lifecycle is a critical set of foundational insights necessary for deep customer understanding and capturing customer verbatims for effective communication and storytelling.

- Quantitative Customer Journey / Experience Research – Having numerical data on customer preferences, actions, and challenges is necessary to satisfy the “C-Suite’s appetite for numbers” and to have a foundation for predictive modeling. VoC and quant research are common efforts that provide this.

Our experience is that qualitative and quantitative research can be designed, executed and summarized in 2-3 months. If this research is already in place, the cycle to results can be shortened to just weeks.

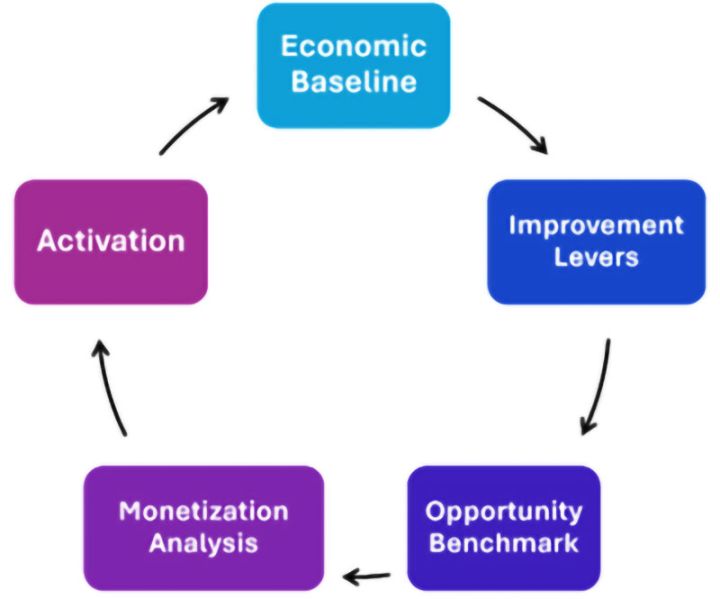

Our business case development process uses the following 5 stages, executed in a fast-cycle, agile manner to build buy-in and momentum.

These steps can be explained as:

- Economic Baseline – Pulling together the baseline of customer spending, channel sales and company operational metrics for use in the analysis. This normally takes 2-3 weeks.

- CX Improvement Levers – Based on the qualitative and quantitative research, customer challenges, pain points, and customer experience gaps are summarized to identify the 4-5 areas of the customer experience that will have a material impact on business results. We typically summarize these and capture qualitative comments and quantitative data in 1-2 workshops.

- Opportunity Benchmarking – This is where the magic typically happens. By integrating the improvement lever insights and the economic baseline data, the opportunity is quantified and justified. This analysis is different for every case example and happens in a 1-2 week period. This establishes the “Overall Opportunity” as the foundation for the business case.

- Monetization Analysis – Moving from a “Quantified Opportunity” into a practical business case requires setting priorities, moving to the next level of analytic detail and turning analytic assumptions into practical, financial estimates. This is best done in an interactive manner with marketing, operations and finance in a 1-2 week period prior to executive review.

- Activation – Moving the plan forward, securing organizational commitment and resources is of course necessary to implementation. Setting the “governance” of the improvement effort is critical to ensuring the implementation moves forward smoothly, aligned with the original vision and sustaining the organizational commitment.

Interested in learning more about how Customer Journey Mapping can help your business? Call us at 1-800-549-7170 or send an email to nitin@goldresearchinc.com

Gold Research is an award-winning Customer Journey Mapping and Research firm with extensive experiences in journey mapping, path-to-purchase research with a special focus in deploying “real-time” and behavioral/neuroscience research formats to gather in-the-moment customer insights.